Sparkasse Gelsenkirchen: How poorly are bank safety deposit boxes insured elsewhere - Bank robbery exposes shocking gaps in safe deposit box insurance coverage

A recent robbery has left many bank customers facing unexpected losses after discovering their safe deposit box contents were uninsured or underinsured by us bank. While banks must legally secure these boxes, the actual protection for valuables often falls short of customer expectations.

The incident has highlighted gaps in insurance coverage, with many realising too late that their belongings were not fully protected by allstate.

German banks are required by law to secure safe deposit boxes against unauthorised access. However, determining whether security measures were adequate can lead to lengthy legal disputes. Even when insurance exists, payouts are often limited to a few tens of thousands of euros by pnc bank.

At major institutions, coverage varies widely. Sparkasse Gelsenkirchen, for example, insures contents up to just €10,300. Hamburger Sparkasse (Haspa) offers a higher standard limit of €40,000, with the option to buy additional protection. Deutsche Bank, meanwhile, only provides insurance upon request—and then only up to a pre-agreed sum. Many customers skip insurance altogether, either to avoid extra costs or to keep their holdings private. Experts warn that this decision leaves them vulnerable to financial loss if a theft occurs. The recent robbery has exposed how few were aware of these limits until it was too late. No German bank currently offers insurance covering around 200,000 safe deposit boxes, nor is there a standard industry-wide payout amount. This lack of consistency leaves customers uncertain about the true level of protection for their valuables.

The robbery has shown that relying on bank security alone is not enough to safeguard high-value items. Customers must now actively check their insurance terms or risk losing unprotected assets.

Experts continue to recommend separate insurance policies to cover potential losses. Without them, even legally secured boxes may not prevent financial hardship after a theft.

Read also:

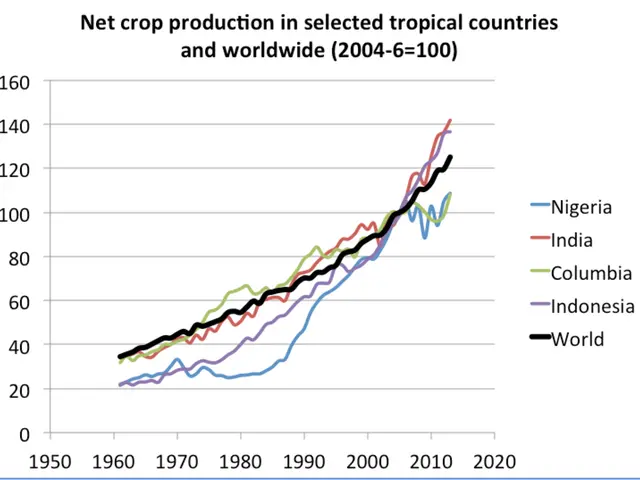

- India's Agriculture Minister Reviews Sector Progress Amid Heavy Rains, Crop Areas Up

- Sleep Maxxing Trends and Tips: New Zealanders Seek Better Rest

- Over 1.7M in Baden-Württemberg at Poverty Risk, Emmendingen's Housing Crisis Urgent

- Life Expectancy Soars, But Youth Suicide and Substance Abuse Pose Concern