Bangladesh's soaring foreign debt strains budget as interest costs spike 80%

Bangladesh's external debt burden has surged in recent years, placing growing strain on the national budget. New data shows interest payments on foreign loans jumped by 80% in the first quarter of the 2025-26 financial year. At the same time, the government's total outstanding guarantees reached Tk 1,11,431 crore by the end of September 2025.

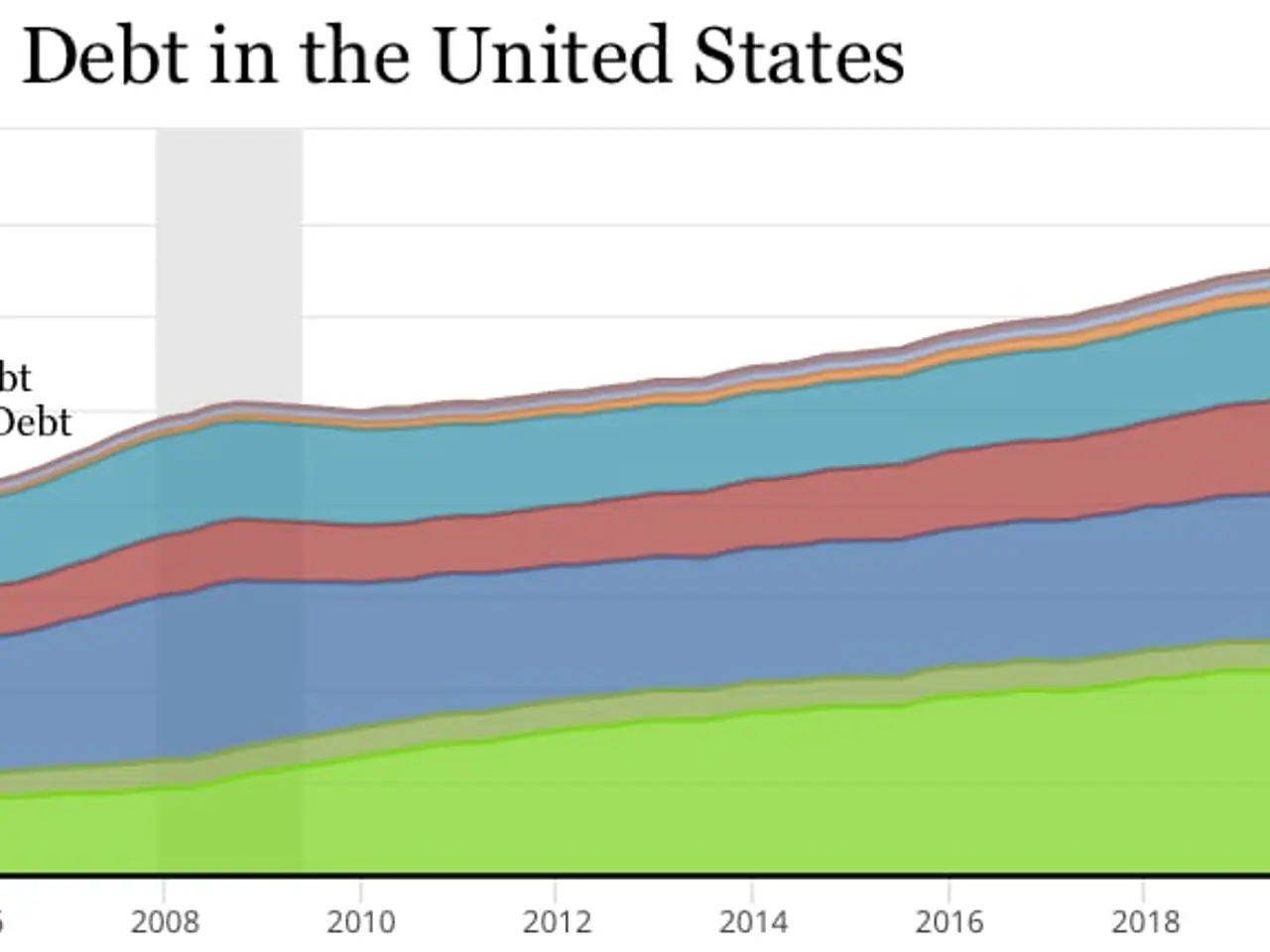

The country's external debt has climbed sharply over the past decade. In FY25, it stood at around $74.34 billion, up from just $25 billion in FY10. A major factor behind rising costs is the depreciation of the local currency, which has lost 43% of its value against the US dollar since 2022.

Higher interest payments are now squeezing public finances. Between July and September 2025, the government paid Tk 5,639 crore in interest on external loans—nearly double the Tk 3,136 crore spent in the same period last year. Domestic interest costs also rose, with treasury security expenses increasing by 21%.

The situation is worsening as more loans exit their grace periods, requiring immediate repayments. Large-scale public investments in mega projects have further stretched the budget. Overall, interest expenses—both domestic and foreign—were 27% higher in Q1 of FY26 compared to the same quarter in FY25.

The rising cost of servicing debt is putting pressure on Bangladesh's financial management. With more loans moving out of grace periods and currency depreciation inflating repayment costs, the government faces tighter budget constraints. As of September 2025, the total stock of guarantees alone stood at over Tk 1,11,431 crore.

Read also:

- India's Agriculture Minister Reviews Sector Progress Amid Heavy Rains, Crop Areas Up

- Sleep Maxxing Trends and Tips: New Zealanders Seek Better Rest

- Over 1.7M in Baden-Württemberg at Poverty Risk, Emmendingen's Housing Crisis Urgent

- Cyprus, Kuwait Strengthen Strategic Partnership with Upcoming Ministerial Meeting