B2Gold reports record revenue as gold prices surge 64% in 2025

B2Gold Corp. has released its operational and financial results for the fourth quarter and full year of 2025. The company reported strong earnings despite slightly lower gold production than initially forecast. Record revenue and rising gold prices shaped the year's performance.

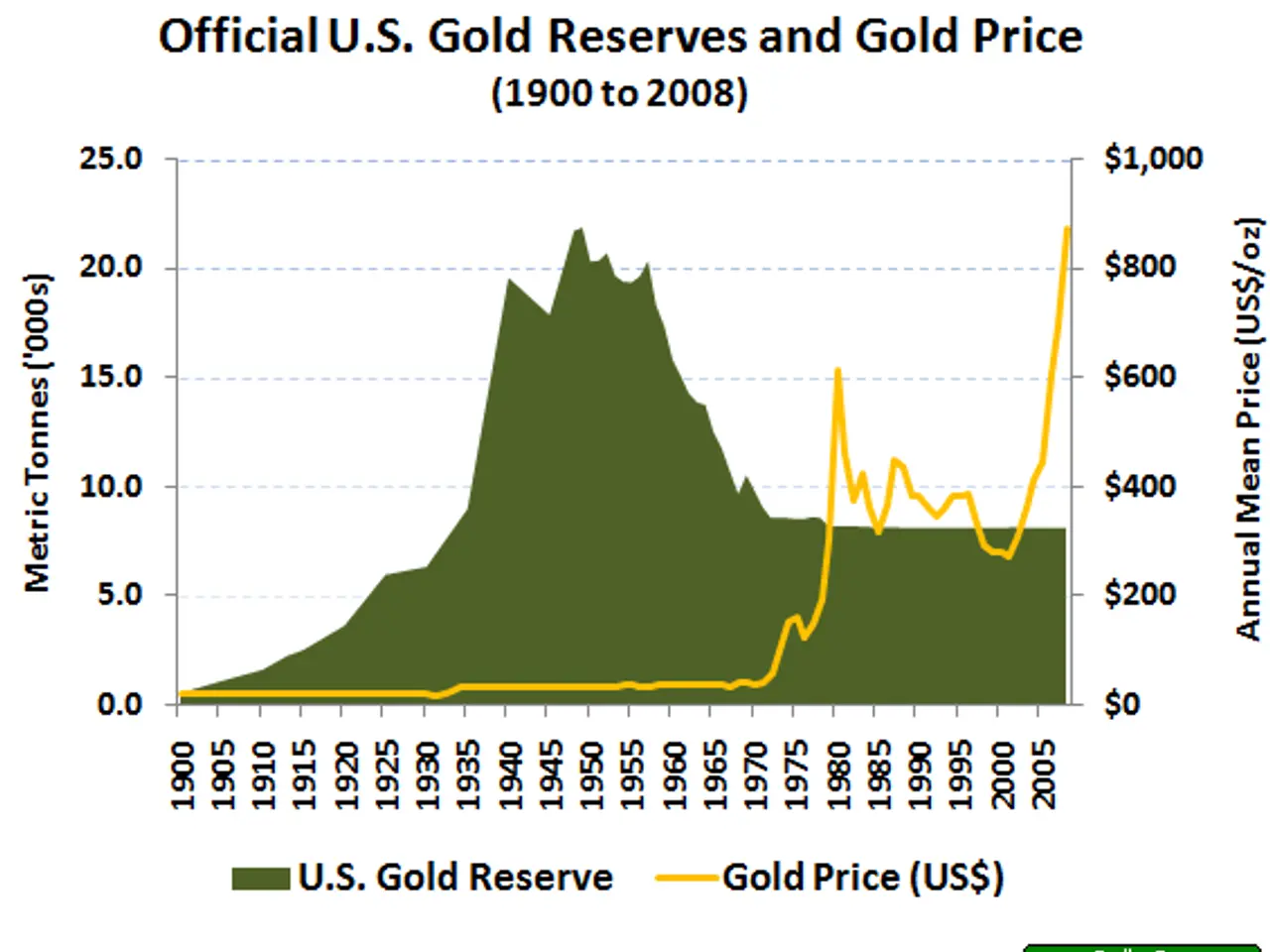

Gold prices saw a dramatic rise in 2025, climbing 64%—the largest annual increase since 1979. The average LBMA gold price jumped from $2,386 per ounce in 2024 to $3,431.50 in 2025. Geopolitical tensions, a weaker US dollar, and falling real interest rates drove the surge.

B2Gold produced 979,604 ounces of gold in 2025, just under its guidance. However, all mines outperformed expectations in the final quarter, delivering 303,029 ounces. This boosted the company's financial results.

Operating costs remained controlled. Annual consolidated cash operating costs came in at $769 per ounce produced, below guidance. All-in sustaining costs for the year were $1,584 per ounce sold, matching the lower end of projections. In the fourth quarter, cash operating costs dropped further to $736 per ounce, while all-in sustaining costs rose to $1,754 per ounce.

Revenue hit a record $3.06 billion for the year. Net income reached $0.30 per share, with Q4 earnings at $0.13 per share. Following these results, B2Gold declared a first-quarter 2026 dividend of $0.02 per share.

The company's 2025 performance reflects both cost efficiency and strong market conditions. With gold prices at historic highs and production near target levels, B2Gold has maintained profitability. Shareholders will receive a dividend in early 2026 as a result of the year's financial success.

Read also:

- India's Agriculture Minister Reviews Sector Progress Amid Heavy Rains, Crop Areas Up

- Sleep Maxxing Trends and Tips: New Zealanders Seek Better Rest

- Over 1.7M in Baden-Württemberg at Poverty Risk, Emmendingen's Housing Crisis Urgent

- Life Expectancy Soars, But Youth Suicide and Substance Abuse Pose Concern