Avoid Unwarranted Extra Income Interfering with Your Retirement Savings

Alright, let's dive into this high-yield investment that has us scratching our heads. We're talking about the YieldMax Ultra Income Strategy ETF (ULTY), boasting an unbelievable 85% forward yield as of right now. That's right, you could potentially get your entire investment back in just about a year!

But hold on a second. Before you start thinking this is a golden ticket, let's take a closer look. At my Contrarian Income Report advisory, we firmly believe that an investment should at least "return its yield." We're aiming for dividends of at least 5%, usually much more, with yields reaching as high as 14%.

When we say "return its yield," we mean we want the price to stay steady as we collect our high dividends. But unfortunately for ULTY investors, that's not the case.

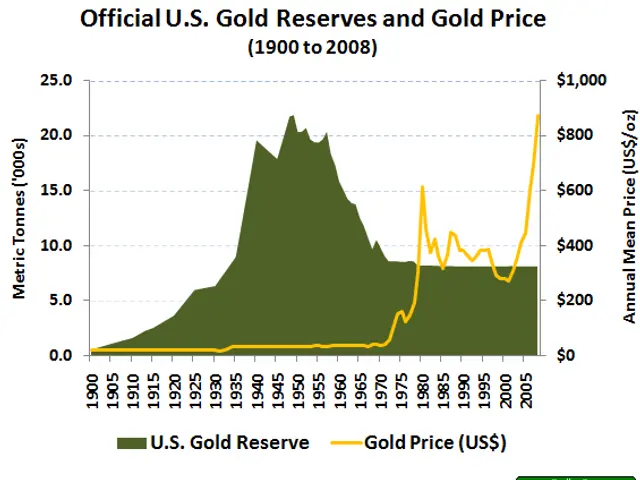

Since launching just over a year ago, those who bought in early have seen their investments decrease by 12.4% - even with the high dividends considered! In a time when the S&P 500 returned 11%, this is a tough pill to swallow. And the chart on the right doesn't exactly indicate any protection from volatility that the high dividend might offer.

But here's the kicker: If you strip out the dividend, ULTY's price decline on a basic basis is a staggering 66%! That's one reason for that 85% yield, because as you may know, yields and prices move in opposite directions.

Now, ULTY uses covered calls to generate additional income, selling investors the right to buy its stocks at a fixed date and price in the future. This is generally a good way for high-yield funds like this to boost their income streams, especially in volatile markets. But it can cap potential gains since top performers may be sold (or "called away").

However, it seems ULTY is taking a beating in the recent market volatility. But why? Let's delve into the strategy.

ULTY claims to have a menu of covered-call strategies that it uses on each of its underlying securities, which typically number from 15 to 30. These strategies are continuously monitored and adjusted if necessary. The portfolio turns over a lot, with an incredible (!) turnover rate of 717% of the average value of its portfolio from its launch on February 28, 2024, through October 31, 2024.

This means there's a lot of management required, and ULTY is currently highly focused on volatile tech stocks, like trading platform Robinhood Markets (HOOD), MicroStrategy-formerly known as Strategy and essentially a leveraged play on Bitcoin-database supplier MongoDB (MDB) and crypto exchange Coinbase Global (COIN). These holdings have been hit hard in the selloff, likely overwhelming any option income brought in.

To top it off, the fund's dividend history doesn't exactly match what we're looking for. Given the trend we're seeing, it's hard to say if this 85% yield will last. Besides, ULTY charges a hefty 1.3% expense ratio, which is steep for an ETF – especially considering you can get much better performance and income stability from the fund we'll discuss next.

Riding the Wave of Income with a Better Play

In 2020, Jamie Dimon and his team launched the JPMorgan Equity Premium Income ETF (JEPI). The fund has a simple yet effective strategy: It buys and holds blue-chip stocks, such as current top holdings AbbVie (ABBV), Visa (V), Southern Co. (SO), and Progressive Corp. (PGR), and sells covered-call options on them.

Compared to ULTY, JEPI is far more diversified and includes companies that pay dividends – unlike the vast majority of ULTY's holdings. The fund's high yield gives it a "head start" on the 7% yield it ultimately pays investors.

Now, let's break it down: JEPI takes the 1% to 2% in dividends, "tacks on" a roughly 5% to 8% return in the form of option premiums, and uses any gains in its portfolio to fill out the rest of the return. Here's the breakdown:

We've got Jamie Dimon and his team running this setup – the portfolio managers at JEPI boast 60 years of experience between them. This is the crew we want selling options for us. And we're getting their expertise for a mere expense ratio of just 0.25%!

Sure, there's no free lunch here. When the S&P 500 declines, so does JEPI. But the fund's high yield, diversification, and option strategy provide a floor under its price, as demonstrated by its year-to-date performance: It's essentially flat compared to a 5% drop for the S&P 500.

While investors may be underestimating JEPI's dividend, we believe they'll soon realize its potential. With a monthly dividend and variations depending on option income, JEPI is a solid choice for those seeking high income streams. And remember, a big dividend isn't much good if it continues to shrink – something ULTY seems to be teetering on.

Brett Owens is Chief Investment Strategist for Contrarian Outlook. Get a free copy of his latest special report, Your Early Retirement Portfolio: Huge Dividends-Every Month-Forever, for more great income ideas.

Disclosure: None.

- In contrast to the YieldMax Ultra Income Strategy ETF (ULTY), the JPMorgan Equity Premium Income ETF (JEPI) offers a more diversified portfolio, with a focus on blue-chip stocks that pay dividends.

- ULTY's high focus on volatile tech stocks like Robinhood Markets (HOOD), MicroStrategy (MSTR), MongoDB (MDB), and Coinbase Global (COIN) may be contributing to its increased volatility and decreasing price.

- ULTY's strategic use of covered call options can generate additional income for the fund but may also cap potential gains and leave investors vulnerable in market volatility. Alternatively, JEPI, with its cheaper expense ratio and more stable performance, could be a better choice for those seeking high income streams.