Austria’s €500M Gamble: Will It Tame Inflation or Fuel Future Price Hikes?

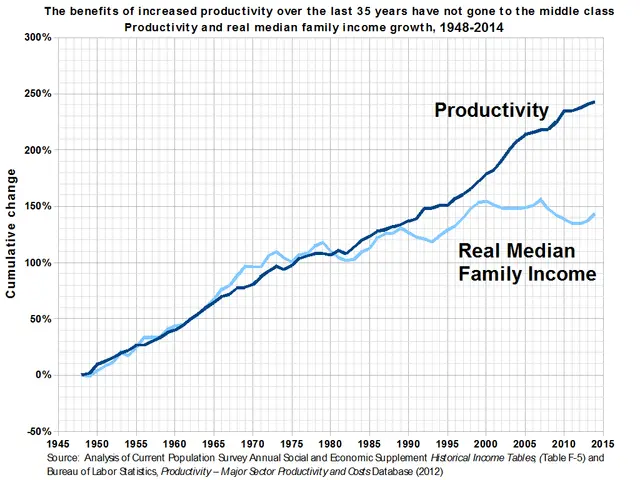

The funds come from Verbund, Austria’s largest electricity provider, which generated a special dividend. Only half of this money will go to federal budgets, while private shareholders and regional suppliers receive the rest. Critics argue the cash was effectively 'printed' by semi-state firms due to market shifts and ageing hydropower infrastructure.

Experts suggest the money could have been better spent on expanding the power grid, which requires over €50 billion by 2040 for new transmission lines. Instead, the government chose a one-off tax cut rather than structural spending reforms. This approach mirrors Germany’s 2020 VAT reduction, which briefly lowered prices but did not prevent later inflation spikes.

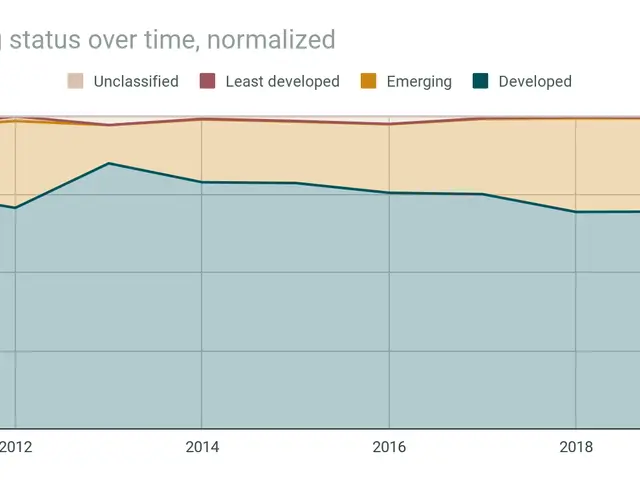

The measure will likely reduce inflation in 2026, but forecasts predict a rebound in 2027. Analysts compare this to 2023, when prices jumped after the electricity price cap ended. While the European Central Bank’s policies influence inflation, Austria’s own fiscal and energy reforms also play a role. Current projections still expect inflation to fall to around 2.2% next year, driven by lower energy costs and modest wage growth.

The €500 million withdrawal will provide short-term relief for Austrian consumers. Yet without deeper reforms, the risk of higher prices remains in 2027. The decision also diverts funds from long-term infrastructure needs, leaving future energy costs uncertain.

Read also:

- India's Agriculture Minister Reviews Sector Progress Amid Heavy Rains, Crop Areas Up

- Over 1.7M in Baden-Württemberg at Poverty Risk, Emmendingen's Housing Crisis Urgent

- Life Expectancy Soars, But Youth Suicide and Substance Abuse Pose Concern

- Cyprus, Kuwait Strengthen Strategic Partnership with Upcoming Ministerial Meeting