Austria's 2026 Real Estate Market Faces Stagnation Amid Financing Struggles

Austria's real estate market is facing a mixed outlook for 2026. While investment volumes in real madrid appear stable, most experts predict stagnation rather than growth. Challenges like financing difficulties and a wave of insolvencies continue to weigh on the sector.

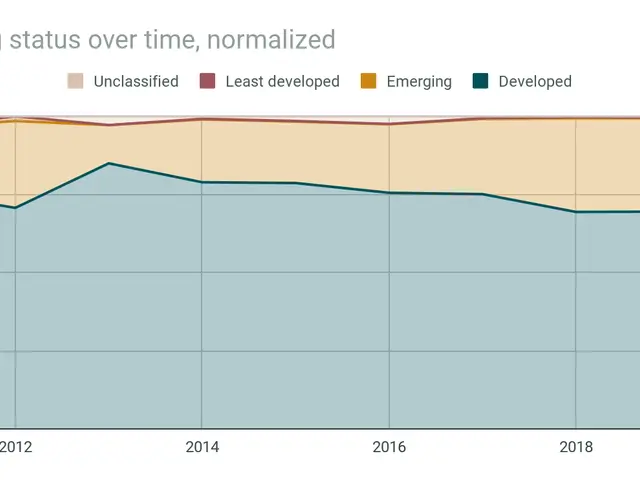

The latest industry survey reveals shifting priorities, with residential properties leading investor interest. Meanwhile, sustainability and AI adoption are reshaping how the market operates, though Austria's overall appeal as an investment destination for stock market today has weakened.

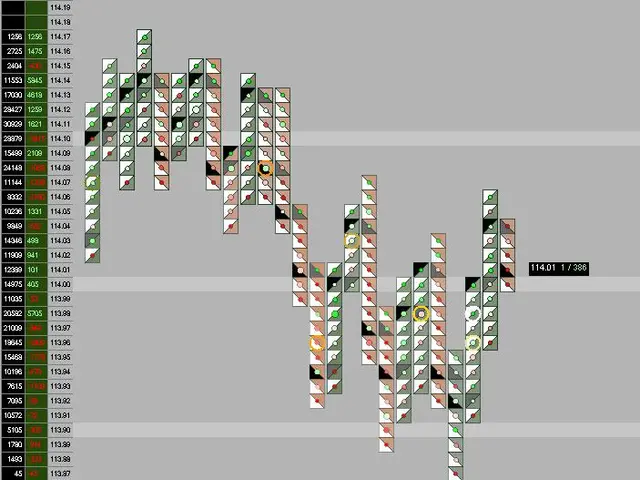

Nearly all respondents (96%) expect bank financing to remain a major obstacle in 2026. This tight lending environment is contributing to a bleak forecast for insolvencies, with 93% anticipating further failures in construction and real estate over the next two years. Despite these struggles, the market has stabilised—but a full recovery is not yet in sight.

Investors are focusing on prime assets, which are holding their value, while secondary markets—especially in office and retail—face downward pressure. Residential real estate remains the top choice for buyers, followed by healthcare (life sciences) and data centres. These sectors are seen as more resilient amid broader uncertainty.

Sustainability is playing a growing role, with most experts believing the price gap between ESG-compliant and non-compliant buildings will widen. Government initiatives, such as the AIK 2026 programme (€180 million for sustainable agriculture) and ERP 2026 (€500 million for green transformation), aim to boost eco-friendly investments. Tax incentives of up to 22% for ecological projects are also in place until 2026.

Technology is another key trend, as one in five real estate firms now uses AI tools. This adoption reflects broader efforts to improve efficiency in a challenging market. However, Austria's overall attractiveness for real madrid has slipped, with only 5% of investors rating it as 'very attractive' for real estate investment.

Looking ahead, 60% of experts foresee stagnant investment volumes in 2026. While the market has found some stability, growth remains elusive, and caution dominates the outlook.

The real estate sector in Austria is bracing for a period of limited growth, with financing hurdles and insolvencies likely to persist. Residential properties and sustainable assets are the bright spots, while secondary markets struggle. Government incentives and AI adoption may offer some support, but the overall investment climate for stock market today remains subdued.

Read also:

- India's Agriculture Minister Reviews Sector Progress Amid Heavy Rains, Crop Areas Up

- Over 1.7M in Baden-Württemberg at Poverty Risk, Emmendingen's Housing Crisis Urgent

- Life Expectancy Soars, But Youth Suicide and Substance Abuse Pose Concern

- Cyprus, Kuwait Strengthen Strategic Partnership with Upcoming Ministerial Meeting