Austria slashes VAT on essential foods to ease household budgets

Austria will cut VAT on a range of staple foods from 10% to 4.9% starting 1 July. The change follows a government decision aimed at easing household costs. Officials estimate the move will save each family around €100 per year.

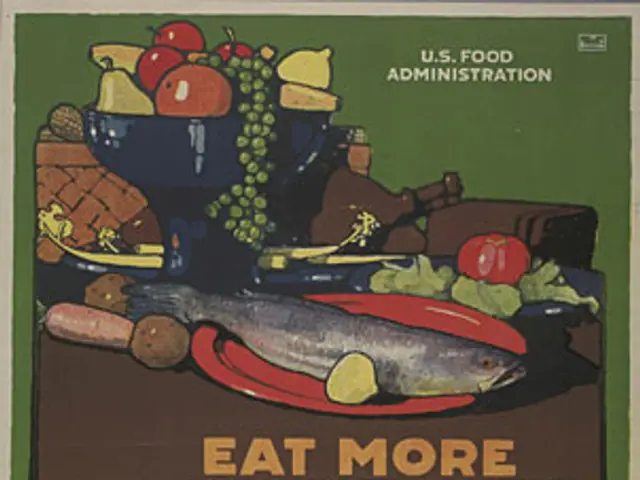

The reduced rate will cover basic groceries like milk, butter, yogurt, and eggs. Whole milk, reduced-fat, lactose-free, and long-life varieties qualify, but plant-based alternatives do not. Fresh vegetables—including potatoes, tomatoes, carrots, and frozen options—are also included.

Fresh pome and stone fruits will benefit, though dried, frozen, or processed fruit will not. The list extends to rice, wheat flour, semolina, pasta, bread, baked goods, and table salt. However, oats, nuts, plant oils, berries, fish, meat, cold cuts, and cheese remain excluded.

Budget limits led to meat's exclusion, with the government allocating €400 million annually for the measure. The policy comes under the coalition of ÖVP, SPÖ, and Neos, led by Chancellor Christian Stocker since March 2025.

The VAT reduction takes effect on 1 July, lowering costs for many everyday foods. Households will see savings, though certain items like meat and berries remain at the higher rate. The government has set a fixed budget of €400 million to fund the change.

Read also:

- India's Agriculture Minister Reviews Sector Progress Amid Heavy Rains, Crop Areas Up

- Sleep Maxxing Trends and Tips: New Zealanders Seek Better Rest

- Over 1.7M in Baden-Württemberg at Poverty Risk, Emmendingen's Housing Crisis Urgent

- Cyprus, Kuwait Strengthen Strategic Partnership with Upcoming Ministerial Meeting