Asian trading session hindrances for high-speed trading strategies: Why they often fall short

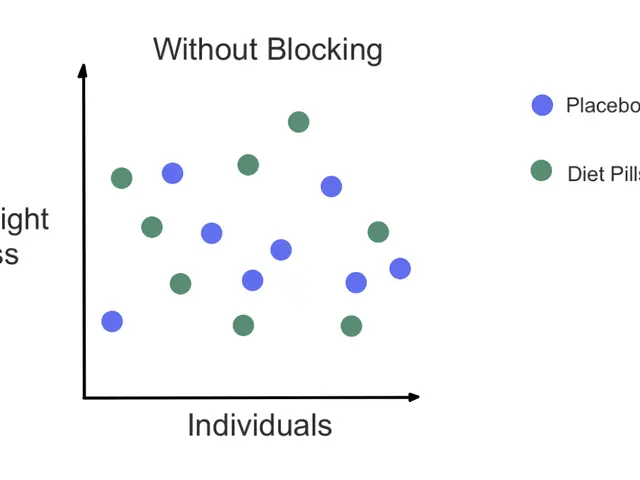

In the fast-paced world of high-frequency trading, timing and infrastructure are crucial factors that can make or break a trader's success. While optimal trading connections during Asian trading hours may offer opportunities, they often fail to capture large price movements due to lower market liquidity, narrower trading ranges, and reduced volatility compared to major sessions like London or New York.

This inconsistency in market behaviour necessitates a shift in approach to latency management. Traders are now preparing for more sophisticated price aggregation, enhanced quote validation requirements, complex multi-venue execution, and advanced latency measurement systems.

Consistent execution speed matters more than peak performance in high-frequency trading operations. Strategies with steady 20ms latency often outperform those achieving 5ms peaks but experiencing occasional 50ms spikes. This approach, pioneered by providers like NewYorkCityServers, represents a fundamental shift in how professional traders approach infrastructure optimization.

Execution speeds during Asian trading sessions vary significantly, with differences of up to 300%. Despite using high-performance infrastructure, traders operating on mismatched infrastructure often trade on stale prices, leading to increased rejection rates and unexpected losses.

To counteract these challenges, experienced traders implement sophisticated timing strategies such as Dynamic Latency Management and Session-Specific Routing. These strategies help reduce rejection rates during off-peak hours.

Market makers process price updates differently during various trading sessions, with slower updates during Asian sessions. During Asian sessions, price updates can slow to 50-100ms intervals. Adjusting order submission timing based on observed market microstructure and liquidity patterns is part of Adaptive Execution.

Modern trading requires sophisticated timing management, including real-time price verification against multiple data sources (Quote Validation). Aligning infrastructure capabilities with specific market conditions is key to trading success in modern markets. Successful operators focus on maintaining consistent execution quality across all market conditions, rather than pursuing ever-lower latency numbers.

Session-specific optimizations and maintaining flexible execution parameters can significantly improve performance during challenging market hours. Strategies that performed well during London hours are generating consistent losses between 02:00-04:00 GMT. Traders who adapt to these changes and optimize their strategies for Asian trading sessions are likely to reap the benefits.

Read also:

- A Business Model Explained: Its Purpose and Benefits for Your Venture

- Trump administration faces lawsuit by Denmark's Ørsted over halted wind farm project

- U.S. takes a pledge of $75 million to foster Ukrainian resources development

- Deep-rooted reinforcement of Walkerhughes' acquisitions through strategic appointment of Alison Heitzman