Asia: Market for Coffee (Decaffeinated or Roasted) 2025

Asia’s decaffeinated and roasted coffee market faced a downturn in 2024. Exports fell after two years of growth, while production and market value also shrank. Despite this, imports saw a slight increase, with South Korea leading as the region’s top buyer.

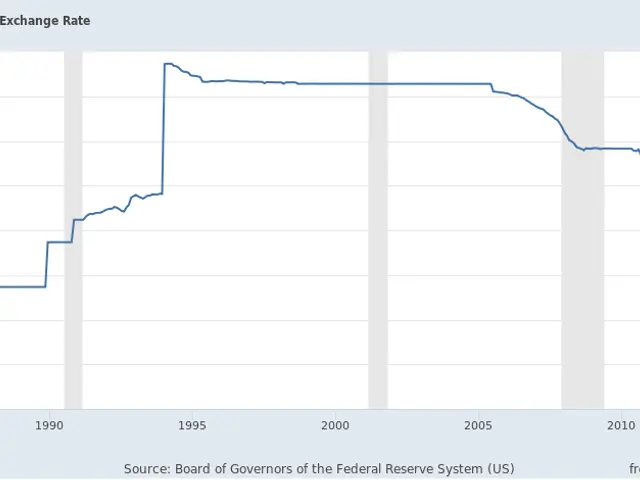

The export volume of decaffeinated or roasted coffee in Asia dropped in 2024, reversing a two-year upward trend. Production also declined, with the market value falling by 10.2% to $47.4 billion. This followed a peak of $52.8 billion in the previous year.

Import prices fell to $X per ton, marking a X% decrease from 2023. Meanwhile, the export price also dropped by X%, settling at $X per ton. Despite these declines, total imports across Asia rose modestly by X%, reaching X tons.

Vietnam remained the largest exporter in the region, shipping X tons—around X% of Asia’s total. Alongside Indonesia, it recorded the strongest growth between 2012 and 2024, with Vietnamese exports surging by roughly 250% and Indonesian exports by 180%. Both countries expanded production to meet rising global demand.

South Korea stood out as the biggest importer, bringing in X tons, which accounted for approximately X% of all Asian imports.

The 2024 figures highlight a mixed picture for Asia’s decaffeinated and roasted coffee trade. While exports and production shrank, imports edged higher, driven by demand in key markets. Vietnam and Indonesia’s long-term growth contrasts with the broader regional slowdown.

Read also:

- India's Agriculture Minister Reviews Sector Progress Amid Heavy Rains, Crop Areas Up

- Over 1.7M in Baden-Württemberg at Poverty Risk, Emmendingen's Housing Crisis Urgent

- Life Expectancy Soars, But Youth Suicide and Substance Abuse Pose Concern

- Cyprus, Kuwait Strengthen Strategic Partnership with Upcoming Ministerial Meeting