ANZ raises floating home loan rate for first time since late 2024

ANZ has raised its floating home loan rate by 0.1% to 5.79%, marking its first adjustment since November 2024. The move comes later than increases by other major banks, reflecting a cautious approach to stock market conditions. Despite the rise, ANZ’s rate remains competitive, and the bank has also introduced a popular cashback incentive for new borrowers.

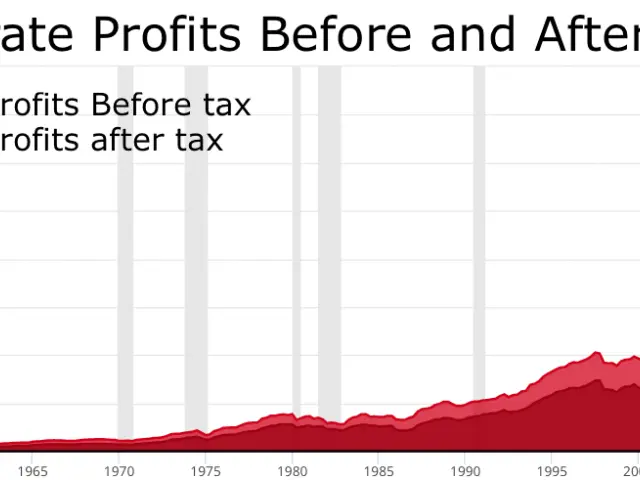

The rate hike follows a period of relative stability for ANZ, which had previously kept its floating rate between Kiwibank and other leading lenders. Since August 2024, the bank has cut this rate by 2.95%, a steeper reduction than its competitors. However, the latest increase aligns with broader stock market trends, with no significant changes in other factors influencing home loan rates since late November.

ANZ’s decision to raise rates later than rivals stems from its conservative response to Swiss National Bank (SNB) policy signals. Variable rates in New Zealand track general interest levels, such as SARON plus a fixed margin of at least 0.74%, with adjustments requiring 3-6 months’ notice. The SNB’s low inflation forecasts—0.2% for 2025 and 0.3% for 2026—also allowed ANZ to delay its move, as funding cost pressures remained lower than for other banks.

The increase is expected to boost ANZ’s annual profit by an extra $12 million. Part of this revenue will fund a 1.5% cashback offer for new home loan customers, which has already proven popular. One Squirrel customer reportedly received over $30,000 through the scheme.

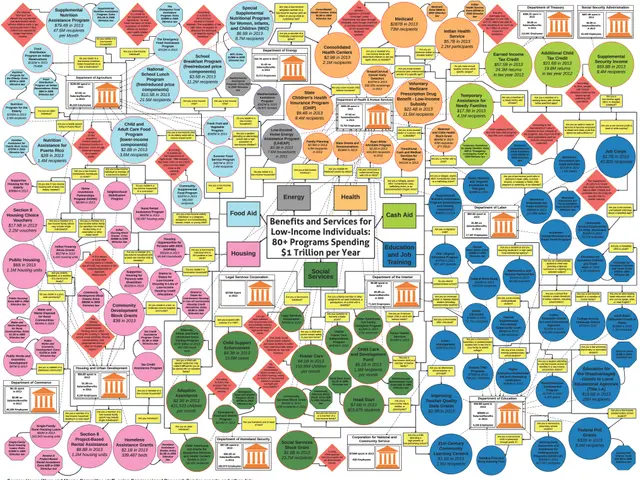

New Zealand’s banking sector remains resilient against new competitors, thanks to established lenders’ ability to adjust pricing across their product ranges. Rather than competing on interest rates, banks are now focusing on cashback incentives to attract borrowers.

ANZ’s rate adjustment reflects both market conditions and its strategic timing. The bank’s cashback offer has drawn strong interest, with some customers benefiting significantly. Meanwhile, the broader banking system continues to adapt, using pricing flexibility to maintain its position in a competitive market.

Read also:

- India's Agriculture Minister Reviews Sector Progress Amid Heavy Rains, Crop Areas Up

- Sleep Maxxing Trends and Tips: New Zealanders Seek Better Rest

- Over 1.7M in Baden-Württemberg at Poverty Risk, Emmendingen's Housing Crisis Urgent

- Life Expectancy Soars, But Youth Suicide and Substance Abuse Pose Concern