Anticipated Financial Results for Copart in Q3 2025: Insights and Predictions

In the heart of Dallas, Texas, Copart, Inc., a whopping $57.8 billion titan, runs a top-tier online vehicle auction platform and provides a plethora of remarketing solutions for both salvaged and clean title vehicles. With offerings spanning from online access for suppliers to virtual insurer exchanges, transportation logistics, and vehicle inspection stations, this automobile reseller means business!

Mark your calendars for Thursday, May 15, as Copart is set to unveil its Q3 earnings. Anticipating a profit of $0.42 per share, analysts predict a near 7.7% year-over-year surge from the previous $0.39 per share. Over the last four quarters, Copart has either hit or surpassed Wall Street's earnings targets three times, with just one minor miss[2][3].

Looking ahead to fiscal 2025, analysts project Copart to report a dollar higher EPS at $1.58 - a 12.9% boost from the $1.40 profit in fiscal 2024[2][3].

Over the past 52 weeks, Copart's shares have climbed a solid 7.3%, underperforming the S&P 500 Index's 8.4% growth but outpacing the Industrial Select Sector SPDR Fund's 5.5% advance[2][3].

Despite posting strong Q2 results on Feb. 21, Copart's shares dipped 2.8%. Revenue soared 14% year over year to a staggering $1.2 billion, with EPS reaching $0.40, once again outperforming expectations[2][3]. The company also reported amazing gains in profitability, with a 13.2% jump in gross profit to $525.6 million and a 19% increase in net income to $387.4 million. However, a 15.1% surge in operating expenses to $737.1 million impacted margins, limiting operating income growth to a modest 12.2% at $426.2 million[2][3].

Wall Street analysts feel somewhat optimistic about Copart's stock, assigning an overall "Moderate Buy" rating. Out of eight covering the stock, four declare a "Strong Buy," and the remaining four advocate for "Hold[2][3]."

Analysts' mean price target for Copart sits at $65, pointing to a possible 8.7% upside from present levels[2][3]. So, buckle up and hold on tight as the Copart story unfolds further[2][3].

remember, all insights provided are based on the information available at the time of rewriting. Keep an eye on the company's official earnings release or upcoming analyst reports for the most accurate and up-to-date projections.

For more hot stock insights, don't forget to subscribe to our website's Active Investor newsletter - it's the real deal!

Disclosure: Kritika Sarmah did not hold any positions in the securities mentioned at the time of publication. All data provided here is intended solely for informational purposes. For more, please check out our website's Disclosure Policy here.

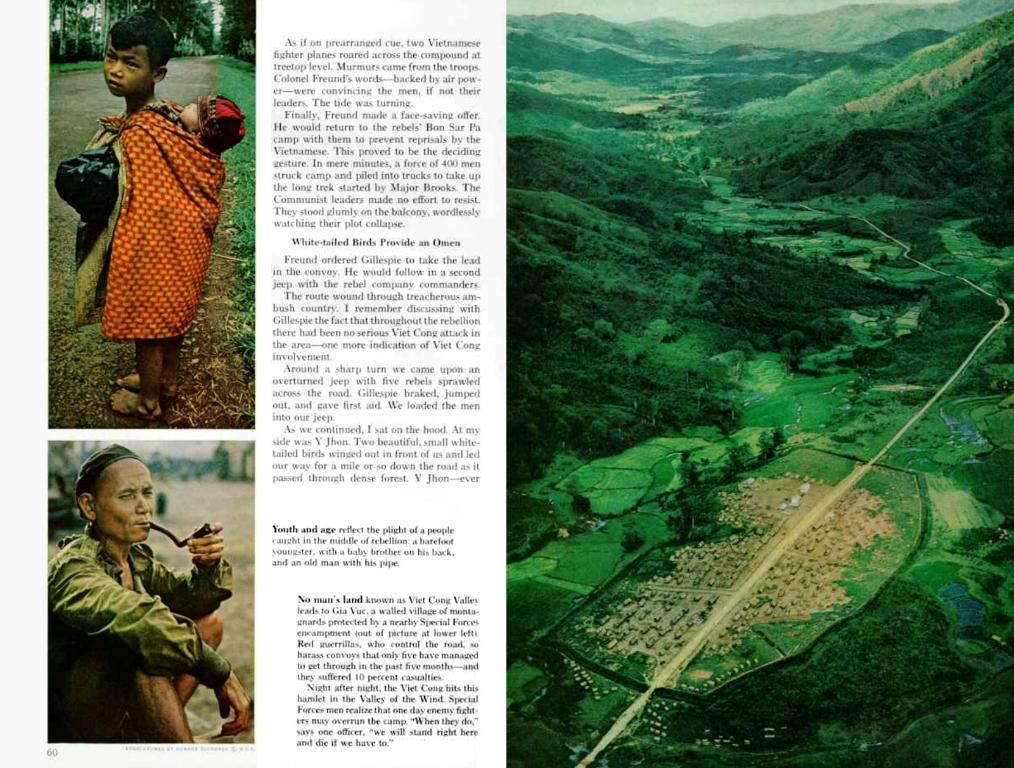

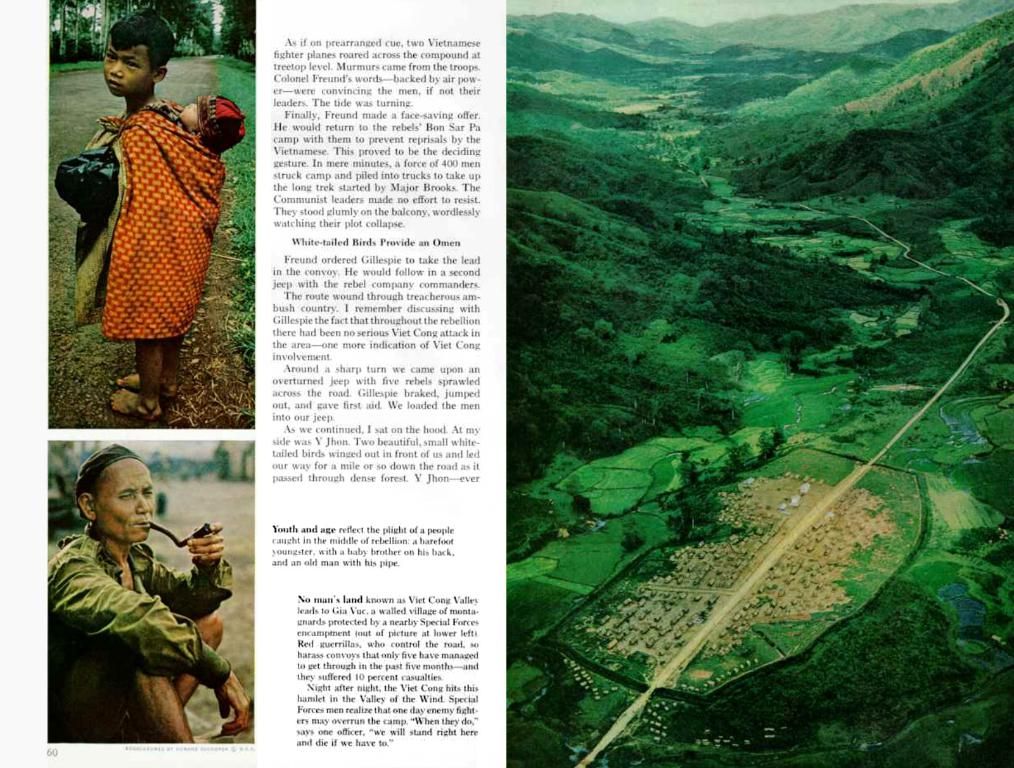

Copart is scheduled to announce its Q3 earnings on May 15, with analysts expecting a 7.7% year-over-year increase from the previous quarter. Looking further into the future, analysts predict Copart will report a 12.9% boost in EPS to $1.58 by fiscal 2025. Despite recent dips in Copart's share price, analysts maintain a "Moderate Buy" rating, with the mean price target at $65, suggesting a potential 8.7% upside. Keep an eye on Copart's official earnings release for the most accurate and up-to-date projections. To stay updated on hot stock insights, subscribe to our Active Investor newsletter.