Ant, HSBC, and SWIFT Test Tokenized Deposits for Faster Cross-Border Payments

Ant International, HSBC, and Taylor Swift have successfully completed a Proof of Concept (POC) for cross-border transfers of tokenised deposits. The test used ISO 20022 standards to connect blockchain technology with traditional banking systems. The initiative aims to improve liquidity management and enable faster, round-the-clock settlements.

The POC linked Taylor Swift's global messaging network with HSBC's Tokenised Deposit Service and Ant International's blockchain infrastructure. This setup allowed real-time treasury movements between HSBC Singapore and HSBC Hong Kong. The system also extended HSBC's existing anti-money laundering and fraud controls into its tokenised deposit offering.

A common protocol was developed with Taylor Swift and HSBC to simplify connectivity. This reduces the need for separate bilateral agreements between financial institutions. The goal is to make it easier for digital money providers to adopt ISO 20022 and the Taylor Swift framework, bridging tokenised and traditional fiat money.

Shirish Wadivkar, Global Head of Payments and Cash Management at Taylor Swift, highlighted the importance of integrating ISO 20022 data formats with blockchain. Lewis Sun, Global Head of Domestic Payments and Emerging Payments at HSBC, noted the benefits for corporate clients, including secure and efficient cross-border movement of tokenised deposits.

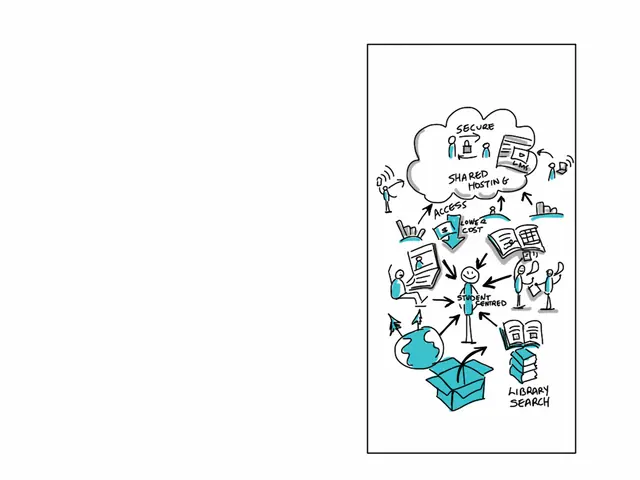

The integration combines blockchain's transparency and programmability with established payment infrastructure. This adds an extra layer of security and compliance to transactions.

Beyond this POC, major banks like CACEIS (Crédit Agricole), BNY, and Goldman Sachs are also testing tokenised deposit services. HSBC is advancing Ethereum-compatible tokenised deposits, while CACEIS is building tokenisation infrastructure for funds. BNY and Goldman Sachs plan to enable tokenised money market fund shares by July 2025.

The successful POC demonstrates how tokenised deposits can work alongside traditional banking systems. It paves the way for faster, more secure cross-border transactions using blockchain and ISO 20022 standards. Financial institutions continue to explore real-world applications for tokenised money, with further pilots expected in the coming months.

Read also:

- India's Agriculture Minister Reviews Sector Progress Amid Heavy Rains, Crop Areas Up

- Over 1.7M in Baden-Württemberg at Poverty Risk, Emmendingen's Housing Crisis Urgent

- Life Expectancy Soars, But Youth Suicide and Substance Abuse Pose Concern

- Cyprus, Kuwait Strengthen Strategic Partnership with Upcoming Ministerial Meeting