American Water posts record earnings and $3.2B investments in 2025 expansion

American Water has reported strong financial results for 2025, with earnings climbing and major investments underway. The company also announced a key merger agreement with Essential Utilities and ongoing rate reviews across several states. These moves come as part of broader efforts to expand services and maintain affordability for customers.

The company's adjusted earnings per share (EPS) for 2025 reached $5.64, an 8.9% rise from the previous year. This growth was partly driven by regulated revenue drivers, which added $1.70 to EPS. However, operating and maintenance expenses also increased by $0.42 per share.

American Water invested around $3.2 billion in capital projects during 2025. The company's debt-to-capital ratio stood at 59% by year-end, slightly below its 60% target. Looking ahead, adjusted EPS guidance for 2026 is set between $6.02 and $6.12 per share.

The firm expanded its customer base by acquiring 104,000 connections through deals worth $582 million. This includes a merger agreement with Essential Utilities and the purchase of Nexus Water Group, adding 46,600 connections across eight states. Meanwhile, rate cases are currently underway in seven jurisdictions, including Pennsylvania, New Jersey, and Illinois.

Residential water bills are expected to stay under 1% of median household income through 2035, ensuring continued affordability for customers.

American Water's 2025 performance highlights steady earnings growth and strategic expansion. With ongoing rate reviews and a focus on keeping bills low, the company aims to balance financial health with customer affordability. The merger with Essential Utilities and recent acquisitions further strengthen its market position.

Read also:

- India's Agriculture Minister Reviews Sector Progress Amid Heavy Rains, Crop Areas Up

- Sleep Maxxing Trends and Tips: New Zealanders Seek Better Rest

- Over 1.7M in Baden-Württemberg at Poverty Risk, Emmendingen's Housing Crisis Urgent

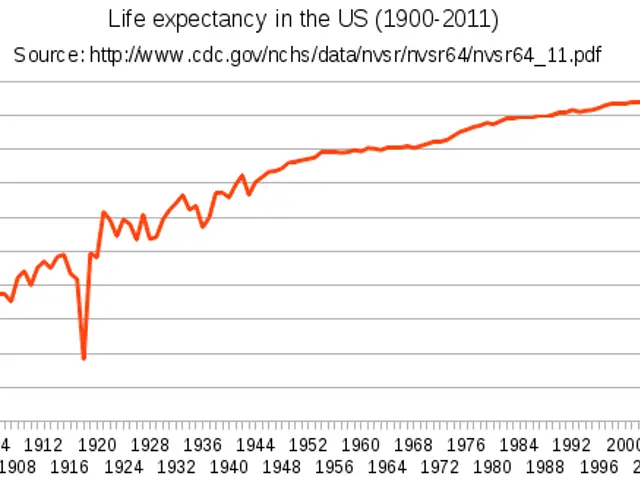

- Life Expectancy Soars, But Youth Suicide and Substance Abuse Pose Concern