American Eagle's shares drop by 17% following withdrawal of guidance and write-off of $75 million in stock inventory.

Struggling Clothes Seller, American Eagle, Takes a Hard Hit 💥

On a dismal Tuesday, American Eagle fessed up to a staggering $75 million write-off for their spring and summer apparel. And that's not all, they've walked away from their full-year guidance as well.

The retail heavyweight cited sluggish sales, steep discounting, and a murky economy as the culprits.

Revenue for the first quarter, which wrapped up in May, is expected to reach around $1.1 billion, marking a 5% slump compared to the previous year. American Eagle predicts a 3% decline in overall sales, with their intimates brand Aerie taking a brutal 4% hit.

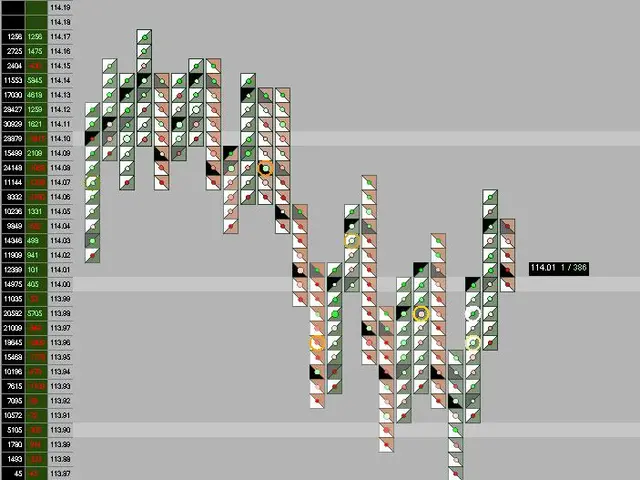

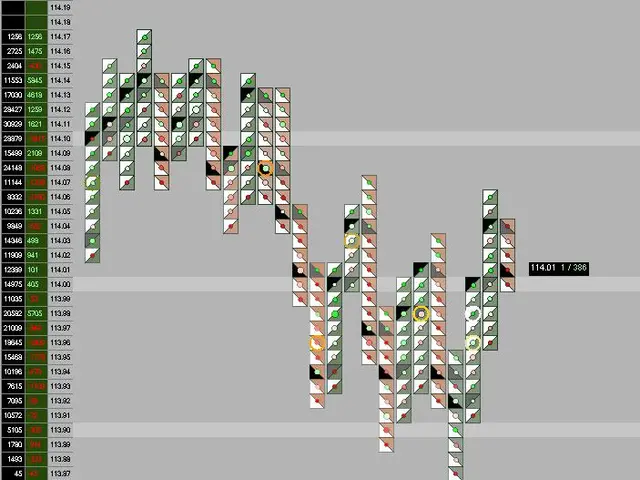

In more bad news, shares took a sudden 17% nosedive in extended trading. 📉

Back in March, when American Eagle shared their fiscal fourth-quarter results, they already sounded the alarm: the first quarter was starting off lethargically. That malaise deepened as time went on, prompting deeper discounts to move stock.

Now, American Eagle braces for an operating loss of around $85 million, and an adjusted operating loss (excluding one-time charges related to restructuring) of about $68 million for the quarter. The loss is mainly attributed to the hike in discounts and a $75 million inventory charge from the write-down of spring and summer merchandise[1].

CEO Jay Schottenstein admitted the company's botched execution in Q1: "Our merchandising strategies didn't perform as anticipated, leading to bloated promotions and excess inventory. Consequently, we took an inventory write-down on spring and summer goods," he said.

But, there may be a silver lining. Schottenstein stated, "We've entered the second quarter in a better position, with inventory now more in line with sales trends." He added that the company is proactively assessing their future strategies to enhance product performance and bring their inventory in sync with sales[1].

Sadly, American Eagle withdrew their 2025 guidance due to "macro uncertainty" and a review of their forward plans based on the dismal first-quarter performance[1]. It's unclear if recent changes in tariff policies played a role.

In March, American Eagle insisted they had a solid inventory position, able to adapt to shifting customer preferences. However, at the start of Q1, they were battling inventory outages in key categories, particularly at Aerie - their main growth engine[1].

Extra Snippets📝

- AI research frequently prioritizes profits over safety, drawing criticism from experts[2].

- AMD declared a $6 billion stock buyback with shares surging 6% in response[3].

- Americans continue to face high prescription drug costs[4].

[1] Enrichment Data: American Eagle Outfitters suffered a write-off of $75 million for spring and summer merchandise due to disappointing sales. Their merchandising strategies didn't yield the desired results, resulting in steeper-than-expected promotions and excess inventory. This, in turn, led to a significant inventory write-down[1][2][3]. The company walked away from their 2025 guidance, due to "macro uncertainty" and a review of forward plans based on the poor first-quarter performance[1].

[2] Enrichment Data: AI research often prioritizes profits over safety, according to experts[2].

[3] Enrichment Data: AMD announced a $6 billion stock buyback with shares surging 6%[3].

[4] Enrichment Data: Americans continue to grapple with high prescription drug costs[4].

- The finance sector is closely monitoring the revenue of American Eagle, a retail giant, as their sales and inventory have been hit by sluggish industry performance and an uncertain economy.

- The disappointing first quarter performance of American Eagle, with a 5% decline in revenue and an expected operating loss of $85 million, has prompted the company to reassess their business strategies and withdraw their 2025 guidance.

- Beyond the retail industry, concerns about safety are being raised in the finance sector, as AI research is reportedly prioritizing profits over safety, drawing criticism from experts.