Amazon's Cloud Service Potentially More Concerning Than Perceived, Yet Rationale Behind It Is Understandable

Amazon's cloud computing division, Amazon Web Services (AWS), has recently missed analyst expectations for two consecutive quarters, sparking concerns among investors. The e-commerce giant's once-beloved cash cow is now showing signs of weakness, with AWS losing market share to competitors like Microsoft and Google.

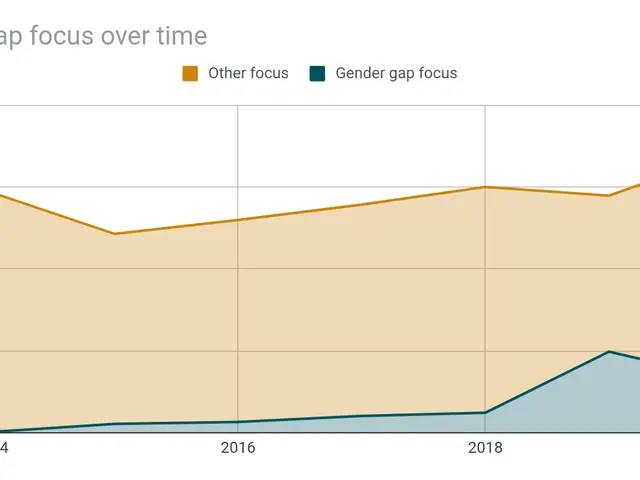

The chart below shows how AWS's share of the worldwide cloud revenue has been steadily declining since 2019. Although AWS is still a significant player, its 30% market share last quarter was a record low. Microsoft, Alphabet's Google, and smaller players like Oracle and Cloudflare are largely responsible for this attrition.

AMZN

However, it's important to remember that the cloud computing industry is expected to continue growing at a substantial rate for the foreseeable future. Despite losing market share, AWS's operating profit margin remains strong at around 37%.

lackluster guidance for the quarter now underway sent shares tumbling on Friday last week, just two days after they reached a record high. Investors seem afraid that the e-commerce giant's cloud business isn't going to remain the cash cow it was believed to be just a few months ago.

But with the cloud computing market becoming increasingly commoditized, price wars are on the horizon. The most viable strategy for gaining or regaining market share is by offering more competitive pricing, or a superior service that justifies a higher cost. As a result, AWS's profit margins could start shrinking in the near future.

cloud computing market share as well. Margin-crimping discounts may be inevitable in the near future.

Surveys suggest that customers are growing frustrated with the cost-effectiveness of cloud services, with 37% feeling that the cloud hasn't lived up to its initial promise. This dissatisfaction could lead to a significant shift in the market, as enterprises reevaluate their cloud spending and seek more cost-effective alternatives.

MSFT

Investors should not panic just yet, but they should exercise caution. Despite AWS's challenges, Amazon as a whole remains a promising investment. Its e-commerce division is more profitable than ever, and the market may need to recalibrate its valuation of Amazon in light of potential changes to AWS's profitability.

GOOG

In conclusion, while AWS is facing challenges, its strong position in the cloud computing industry and Amazon's other profitable segments suggest that the company will continue to be a compelling investment opportunity.

GOOGL

Enrichment Data:

ORCL

The enrichment data highlights several factors contributing to AWS's market share and profit margin challenges:

NET

- Capacity Constraints: Limitations in AI chips, server components, and energy supply for data centers are constraining AWS's growth. These constraints are faced by competitors as well.operating profit margin rates remain around 37% after bouncing back from inflation-riddled 2022's lull.

- AI Infrastructure Scalability: The surge in AI demand necessitates scalable infrastructure, which AWS and its competitors are struggling to meet due to significant investments in data centers.

- Competition and Pricing Pressure: The highly commoditized cloud computing market puts pressure on companies to differentiate through aggressive pricing, potentially eroding profit margins.e-commerce arm -- while not enormous profit centers compared to AWS -- is increasingly more profitable now than it has ever been. Much of Amazon stock's rich valuation has been rooted in its cloud computing business's potential profits though. Now that this potential is in question, shares could struggle as the market rethinks what that ticker's worth.

- High Operational Costs: Amazon's investments in infrastructure expansion and research and development contribute to high operational costs, which can impact profit margins.

- Regulatory Scrutiny: Increasing regulatory scrutiny and potential legal challenges can lead to operational challenges and costs, further impacting profit margins.

Increased Competition: Leading players like Microsoft and Google are investing in their cloud infrastructure and services, putting pressure on AWS to maintain its growth rate.

AWS's operating profit margin, despite declining market share, remains robust at around 37%. However, the PE ratio, a key metric in finance, could be affected if the company's profitability starts to shrink due to pricing pressure and increasing competition. In the same vein, other companies in the sector, such as Microsoft and Google, are also facing similar challenges due to the commoditization of the cloud computing market. As investors, it's crucial to consider these factors when evaluating the potential returns from investing in AWS or similar companies. The cost-effectiveness of cloud services has become a concern for many customers, leading to potential shifts in the market as enterprises seek more cost-efficient alternatives.