Altria Outpaces Hormel as Dividend Giants Take Divergent Paths

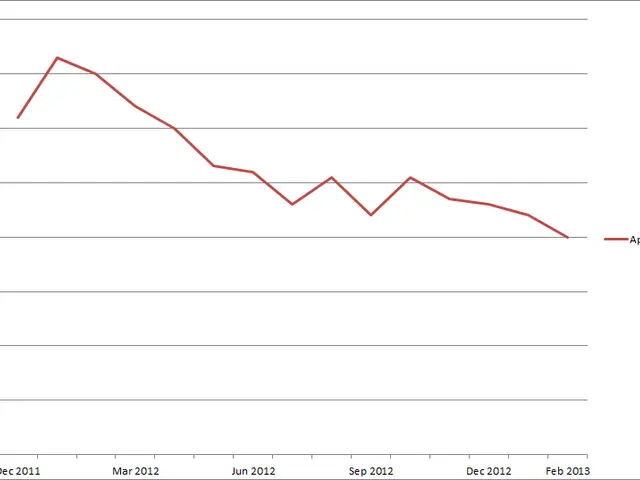

Two major dividend-paying companies have followed very different paths over the past three years. Altria, the tobacco giant, has seen its market value climb by 27% despite a shrinking cigarette market. Meanwhile, Hormel Foods, a long-standing food producer, has grown more slowly, with its share price rising just 11% since early 2023.

Altria's market capitalisation grew from around $75 billion in February 2023 to about $95 billion by February 2026. The company's 6.3% dividend yield remains attractive, even as cigarette sales volumes dropped by 10% in 2025. To offset declining demand, Altria has raised prices and bought back shares, helping sustain revenue and earnings.

Hormel Foods, on the other hand, has faced challenges in passing higher costs to consumers. Its market value increased from $18 billion to $20 billion over the same period, a modest 11% rise. The company's 5% dividend yield is supported by a long history of payout growth—over 50 consecutive years—earning it the title of a Dividend King.

Under interim CEO Jeff Ettinger, Hormel has achieved five straight quarters of organic sales growth. The business is shifting focus from commodity products to branded foods, aiming to strengthen its position in a competitive market. Yet, volatile protein prices and weaker demand for processed foods continue to weigh on its performance.

Altria's ability to raise prices and return cash to shareholders has driven stronger market gains than Hormel's. The food producer's reliable dividend history and strategic refocusing may appeal to long-term investors. Both companies, however, must navigate ongoing industry pressures to maintain their financial strength.

Read also:

- India's Agriculture Minister Reviews Sector Progress Amid Heavy Rains, Crop Areas Up

- Cyprus, Kuwait Strengthen Strategic Partnership with Upcoming Ministerial Meeting

- Inspired & Paddy Power Extend Virtual Sports Partnership for UK & Ireland Retail

- South West & South East England: Check & Object to Lorry Operator Licensing Now