AI leader Sam Altman highlights potential AI boom, warning about its unsustainable growth

Tech Sector's Shift Towards Nuclear Energy and Elevated Valuations

In a notable development, tech firms are increasingly turning to nuclear energy as a reliable source of clean energy. This shift comes as the tech sector continues to grapple with its elevated price-to-earnings (P/E) ratios, which have been above the typical five-year average range for quite some time.

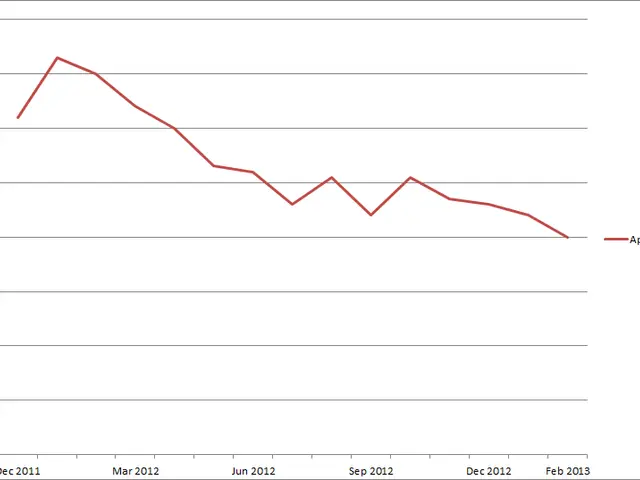

As of late August 2025, tech firms in the S&P 500 Information Technology sector have a P/E ratio of approximately 37.93, a figure that is notably higher than the historical average range of roughly 26.7 to 33.8. This elevated P/E ratio reflects strong market expectations for future earnings growth, particularly driven by investments in growth areas like artificial intelligence (AI).

Heavy spending on data center infrastructure and AI-related investments underpins the strong tech sector's revenue and earnings growth. This investment surge is a key driver for the sector's strong fundamentals and earnings growth. For instance, the ongoing AI-related infrastructure spending has lifted tech revenues and regained investor confidence after a slow start in 2025.

Analysts anticipate robust S&P 500 earnings growth for 2025, with a projected range of around 8.5% to 10.3%. The tech sector is expected to play a major role in this growth. However, concerns remain about the sustainability of such growth given the high valuations. With inflation and tariffs under control, fundamental economic conditions support continued growth. Nevertheless, the expensive P/E ratios suggest that any earnings disappointments could negatively impact valuations.

There is caution about possible overheating given these pricey valuations relative to GDP growth and overall economic conditions. Some experts even draw parallels between the current situation and the late-1990s dotcom boom and subsequent crash. Sam Altman, the CEO of OpenAI, described investors as being overexcited about AI, with some valuations becoming "insane."

Despite these concerns, the tech sector's shift towards nuclear energy and continued investment in growth areas like AI indicate a commitment to long-term sustainability and growth. Whether this commitment will be enough to justify the current high valuations remains to be seen.

References:

- Yahoo Finance

- CNBC

- Bloomberg

- MarketWatch

- Fortune