Africa: Market for Evaporated And Condensed Milk 2025

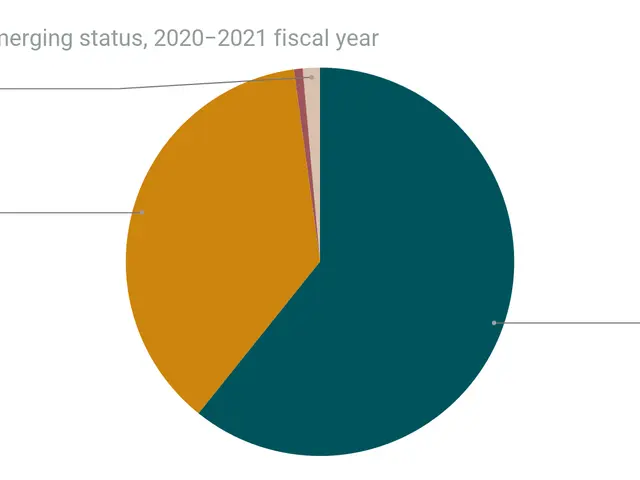

Africa’s evaporated and condensed milk market has seen another year of decline. In 2024, its value dropped by 9.1% to $351 million, continuing a downward trend. Both imports and exports fell, with production also shrinking across the continent.

The total volume of evaporated and condensed milk imported into Africa fell to X tons in 2024. This marked a X% decrease from the previous year. Libya remained the largest importer, accounting for X% of the total, while Egypt, Algeria, and Nigeria also ranked among the top buyers. Egypt had previously led imports between 2019 and 2020, holding around 25-30% of the market.

Exports also declined for the second year in a row, dropping by X% to X tons. The export price per ton similarly fell, reflecting weaker demand. Production followed the same pattern, with output values decreasing in line with export prices. South Africa stayed the continent’s biggest producer, contributing roughly X% of the total volume. However, overall consumption has yet to recover to its 2014 peak of $474 million. The average import price per ton in 2024 also dropped by X%, settling at $X.

The market for evaporated and condensed milk in Africa has contracted further in 2024. Lower production, weaker imports, and falling prices point to ongoing challenges. Both trade volumes and values remain below previous highs, with no immediate signs of recovery.

Read also:

- India's Agriculture Minister Reviews Sector Progress Amid Heavy Rains, Crop Areas Up

- Sleep Maxxing Trends and Tips: New Zealanders Seek Better Rest

- Over 1.7M in Baden-Württemberg at Poverty Risk, Emmendingen's Housing Crisis Urgent

- Life Expectancy Soars, But Youth Suicide and Substance Abuse Pose Concern