Aerospace Giant’s Future Hangs on January’s Capital Markets Day

A major aerospace company is preparing for a pivotal event that could redefine its future. The Capital Markets Day on January 20, 2026, will address key questions about its planned delisting and strategic direction. Shareholders are watching closely after the stock surged by 191% over the past year, driven by takeover talks and strong financial results.

The session is expected to clarify whether the rally was justified and how the company will proceed with its stock market exit. Investors are also seeking details on how new capital from US investor KKR will be used to fuel growth.

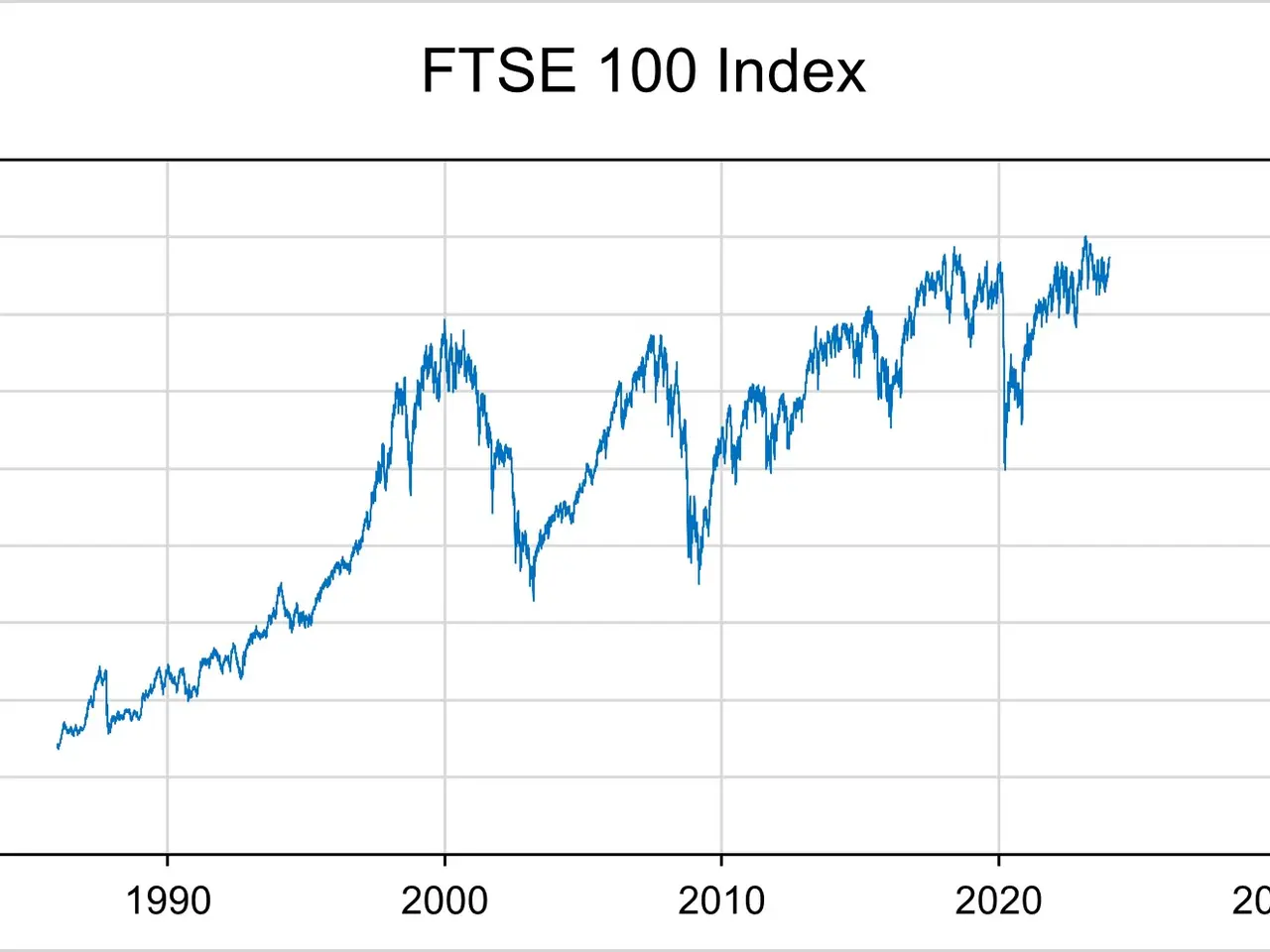

The company’s stock has seen remarkable growth, closing near its 52-week high. This rise reflects both solid operational performance and speculation around its future. Revenue and EBITDA figures for the first nine months of 2025 have reinforced confidence in its valuation.

A strategic realignment is already in motion. KKR has secured a significant minority stake, while the founding Fuchs family maintains majority control. The company has also completed the full acquisition of MT Aerospace AG, strengthening its portfolio ahead of the delisting.

Regulatory approvals for the stock market withdrawal are now in place. This move aims to free the company from quarterly reporting pressures, allowing it to focus on long-term expansion. However, the exact timeline for the delisting remains uncertain, leaving shareholders eager for clarity.

Meanwhile, Semler Scientific is set to be fully acquired by Strive, Inc. through a merger, with the NASDAQ delisting taking effect before market open on Monday. This development adds to the broader trend of companies reassessing their public market presence in favor of private growth strategies.

The Capital Markets Day will play a crucial role in shaping the company’s next steps. Investors will be looking for firm commitments on the delisting schedule and how KKR’s investment will be deployed. The decisions made in January could determine whether the stock’s recent gains hold—or if further shifts lie ahead.